Pin Bars Explained

Introduction:

Pin bars are powerful candlestick patterns that can help you identify potential price reversals.

Here’s a PinBar detection arrows indicator and a scanner:

https://abiroid.com/product/abiroid-pinbar-scanner/

What is a Pin Bar?

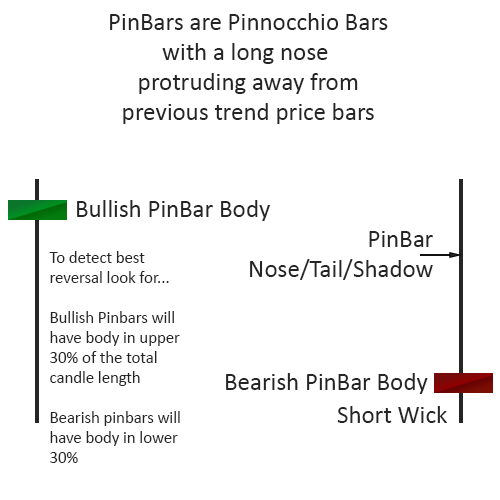

A pin bar is a single candlestick pattern with a small body and a long “nose”. The key parts are:

- Nose/Tail/Shadow: The long, pointy part that sticks out.

- Body: The small rectangular part in the middle.

- Short Wick: The short part opposite to the nose. Sometimes it’s not even there.

Detecting Pin Bars:

To spot a pin bar:

- Look for a long nose sticking out.

- Check for a small body, which shows indecision.

- Pin bars are most powerful after a strong trend.

Good signals when:

- Open and close within previous candle.

- Candle wick minimum 3 times the length of the candle body

- Long nose protruding from all other candles (must stick out from all other candles)

Types of Pin Bars:

There are different types:

- Bullish Pin Bar: After a downtrend, it signals a potential upward reversal.

- Bearish Pin Bar: After an uptrend, it suggests a potential downward reversal.

- Long-Tailed Pin Bar: A pin bar with an extra-long tail can indicate a strong reversal.

- Shooting Star: A bearish pin bar with a small body and a long upper tail. And no wick.

- Hammer: A bullish pin bar with a small body and a long lower tail. And no wick.

Trading Strategies:

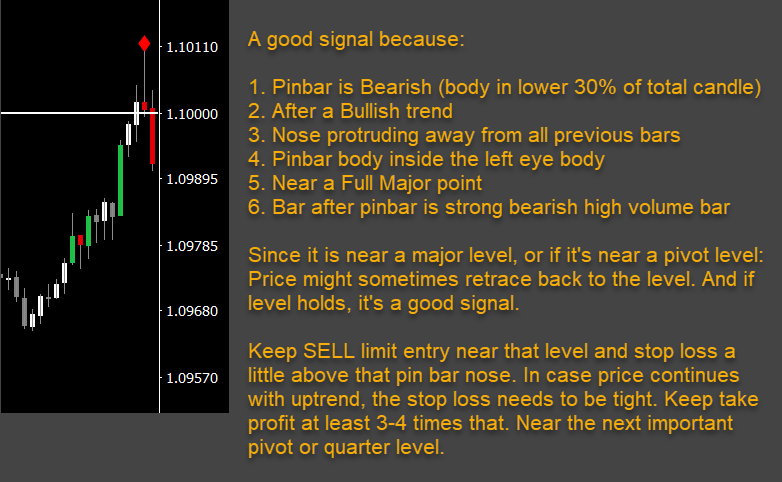

- Pin Bars and Quarter Points: Look for pin bars near quarter points (1.00000 = Full Major level, 1.50000 Half Level, 1.25000 quarter levels).

- Pin Bars and Pivots: Combine pin bars with pivot points; pin bars near pivot levels are strong reversal signals.

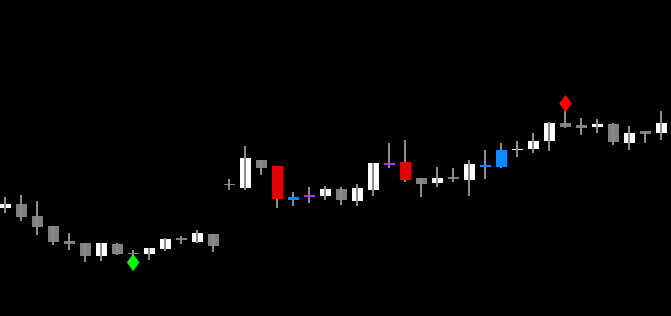

Problem with major levels and pivots is that sometimes price will test these levels a few times. So you might get multiple pin bars like this:

Where price doesn’t reverse immediately. Which is why with these levels, it’s best to look for a strong volume candle reversing after a pin bar. Which validates the reversal.

- Pin Bars and Overbought/Oversold: Combine pin bars with indicators like CCI, RSI or Stochastic. Pin bars at overbought/oversold levels have more chance of reversal.

- Pin Bars and Engulfing Bars: Pay attention to pin bars that appear before or within engulfing patterns.

Common Pitfalls:

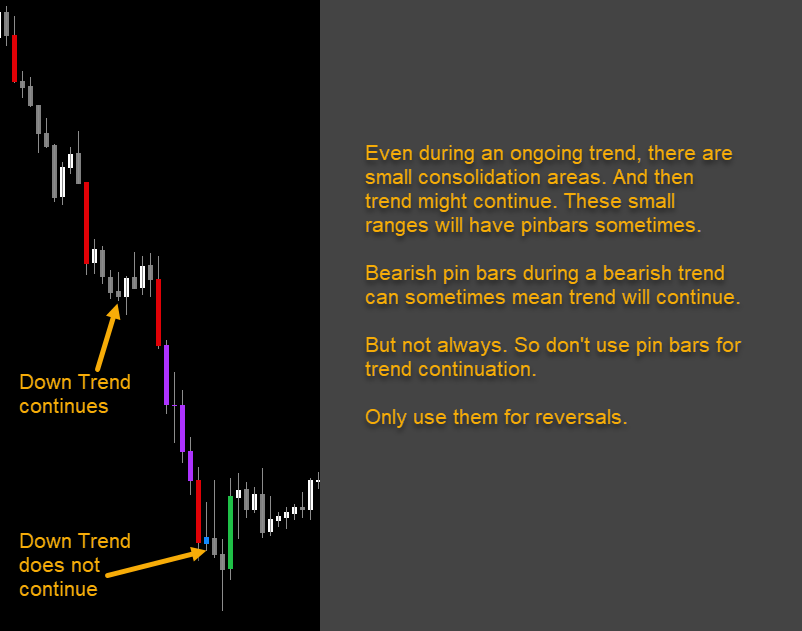

- Trading Pin Bars in the Wrong Context: Pin bars work best after strong trends. Avoid using them in consolidating markets.

- Continuation Pinbar: If a Bullish pinbar appears after a bullish trend, we might think it signals trend continuation. But it’s not always the case. Pin bars are best as reversal signals. Not so good for trend continuation:

- Not placing close stops:

Conclusion:

Pin bars are a valuable tool for identifying potential reversals in forex trading.

A good signal can be rare. So don’t expect too many pinbars to trade. Most you’ll need to skip. Which is why a scanner can be useful. As it scans all pairs continuously.