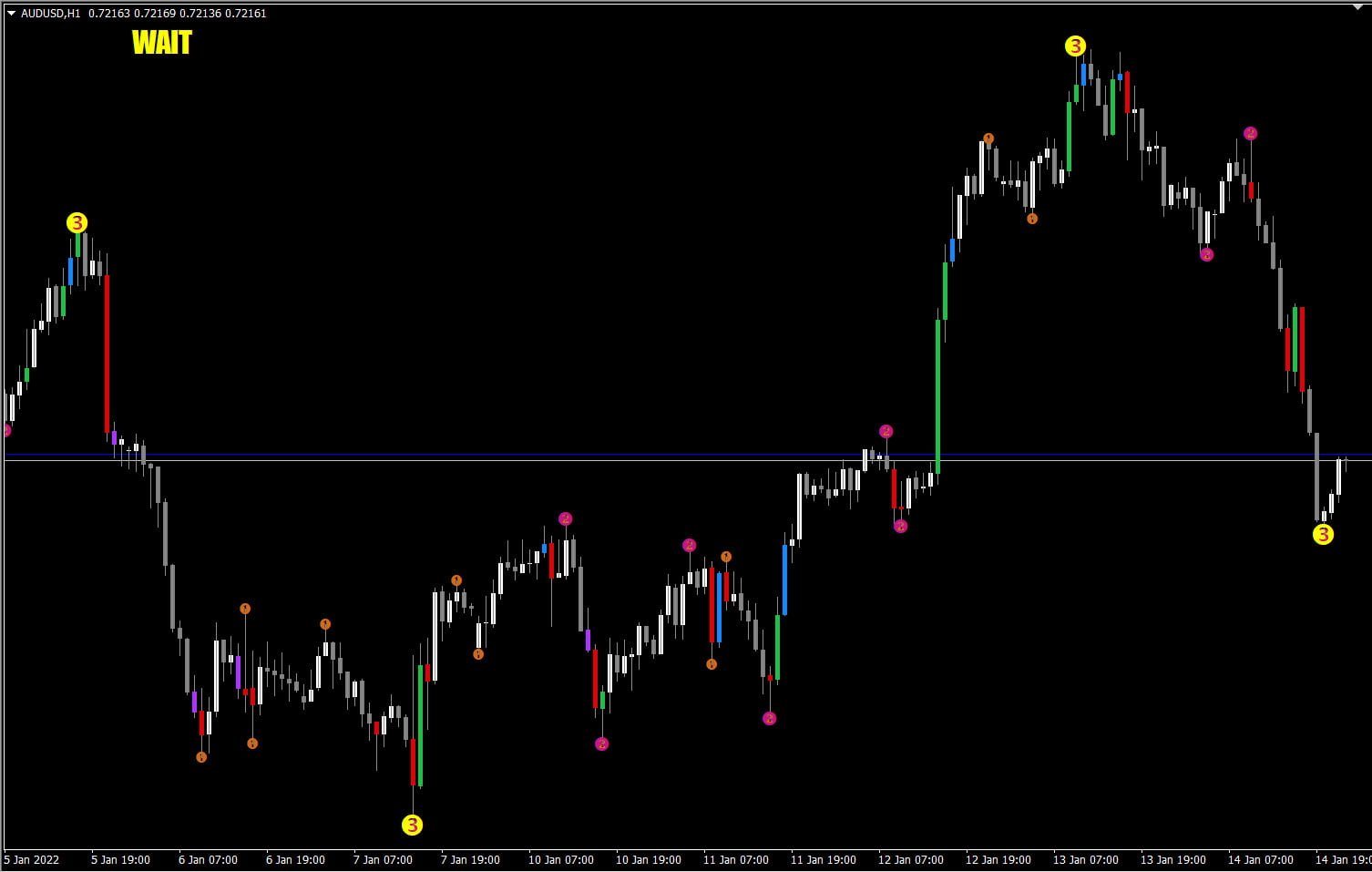

Understanding Semafors 3LZZ

Hey guys,

This post will help you understand the different terms in creating the 3LZZ Semafor (3 level zz semafors).

I have used the 3LZZ_TRO_EXT.ex4 (MT4) in my examples here:

Semafors:

Unlike what it appears like in the chart, Semafors are not points of reversals. They are simply high and low points.

Which is why, when a new high/low is created, a semafor will shift to the new bar. So one should be very careful trading semafors.

As it’s important to wait and see that the reversal is actually real.

You can use tools like:

- Halftrend or Supertrend to see if trend indeed has reversed.

- Pivot points or Fibo or SR levels to see strong Support/Resistance points. Where reversal is most likely

- Strong volume bars which means that Buyers for a Bullish (Green) bar or Sellers for a bearish (Red) bar are increasing which makes reversal stronger

3LZZ uses 3 types of points.

Semafor 1: smaller high/lows

Semafor 2: medium

Semafor 3: Longer

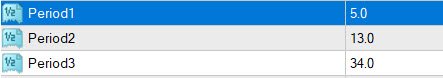

These all use Zigzag to calulate the Semafor points. Period is actually called Depth in Zigzag indicator. And Deviation and Backstep are comma-separated:

Semafor 1: Depth: 5, Deviation: 1, Backstep: 3

Semafor 2: Depth: 13, Deviation: 8, Backstep: 5

Semafor 3: Depth: 34, Deviation: 13, Backstep: 8

You will notice that these are all numbers from the Fibonacci sequence: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on 🙂

Zigzag Terms:

- Deviation (Percentage) — The minimal price change required for the indicator to form a high/low.

Percentage of change that represents when the trend changes.

For example, if the price drops 5% from the high, then the Zigzag indicator show a red line falling, showing that the trend has changed.

- Depth (No. of Bars) — Minimum interval during which the indicator will draw a new high/low if the Deviation changes.

So within “depth” (period) number of bars, there cannot be another high/low.

- Backstep (No. of Bars) — Number of bars (candlesticks) required to separate two local extremes. At this interval, new highs/lows will not be drawn if they differ in size from the prior ones. So backstep needs to be less than depth. Or else it can’t work.

Let’s take default values:

Depth: 12

Deviation: 5

Backstep: 3

So, it will look at past 12 (depth) bars and find highest high and lowest low levels. Distance between the two levels should be more than 3 (backstep) bars.

Now, let’s say that the latest extreme level was a low. A few bars back (more than backstep 3).

And now at current bar, price deviates more than 5% upwards. Then it will create a red zigzag line to the high of this newest bar.

If price in next bar still shifts upwards, then zigzag line will move to the new high.

Let’s say that more than 3 (backstep) bars have passed again. And price now goes 5% deviation lower. Then a new red zigzag line will be drawn to the low of this newest bar.

And so on…

Check out the free Simple Semafor Scanner:

And a more complex 3LZZ Scanner with a different strategy: