ProfitPercent Arrows MA Confluence

65 $

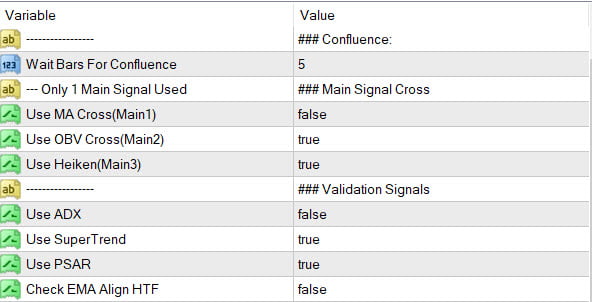

Buy from MQL5- Main Signal Indicators (Any One): MA Cross (In-built) or Hull, OBV Cross, Heiken Ashi Cross

- Validation Indicators (Preferably less than 3): OBV (with Min Distance), Heiken Ashi, ADX, SuperTrend, PSAR, Higher TimeFrame EMA Alignment

- If MA Cross and OBV Cross both are false, only then Heiken Cross will be taken as Main Signal.

All products are non-refundable. Since these are digital products. No source code available, only executables. Please read product description carefully before buying.

Download Demo:

Note: Demo only works for EURUSD.

Download Extras:

Download Free Scanner:

You can also Buy Arrows from Metatrader:

Arrows:

https://www.mql5.com/en/market/product/51078/

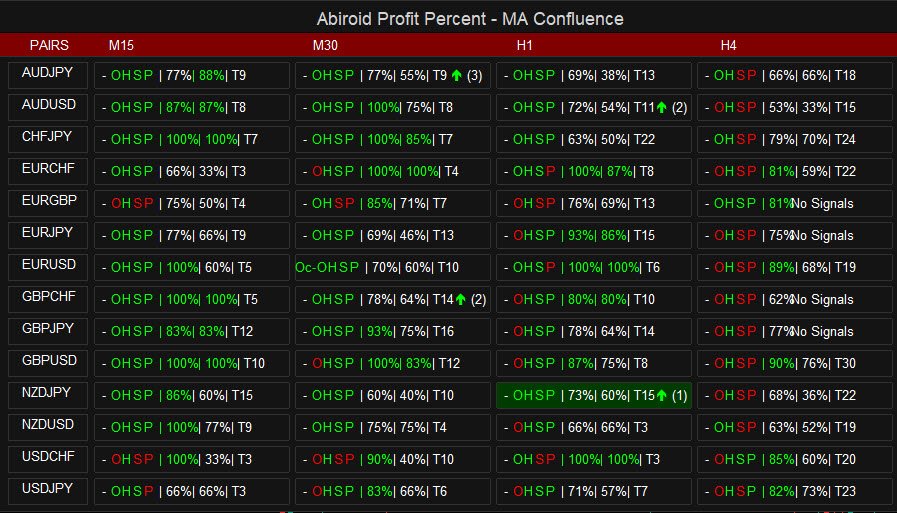

About Dashboard: Don’t use too many validating Indicators as it might slow down the Dashboard a lot when using too many pairs (like all 28-pairs) and timeframes.

If using 1 Main Indicator and 3 validating indicator, it can take about 1-2 seconds for an individual pair/timeframe. Depending on Validating indicator used.

SuperTrend is slower than remaining. So, best configuration is to use 1 Main Indicator and 2 Validating indicators.

The video tutorial for Common Profit Percent Settings is available here:

And video tutorial for this MA Confluence Indicator is here:

Here’s a post about Common Settings for all Profit Percent Series Indicators:

https://abiroid.com/indicators/profit-percent-series-common-settings

So let’s begin…

What is Confluence?

From Investopedia:

https://www.investopedia.com/terms/c/confluence.asp

Confluence is the combination of multiple strategies and ideas into one complete strategy.

Confluence occurs when two separate ideas/strategies are used together to form an investment strategy that is in line with an investor’s risk profile and goals.

This term can also be used when doing technical analysis, by looking at charts and developing levels where different indicators are combined to help identify possible opportunities.

MA Confluence Strategy:

Main Signal Indicators (Any One): MA Cross (In-built) or Hull, OBV Cross, Heiken Ashi Cross

Validation Indicators (Preferably less than 3): OBV (with Min Distance), Heiken Ashi, ADX, SuperTrend, PSAR, Higher TimeFrame EMA Alignment

Main Signal will first generate a BUY/SELL Signal when:

If MA Cross True (Main):

Use In-Built MA or Hull MA and search for Fast MA and Slow MA Cross

If OBV Cross True :

If MA Cross is false, only the OBV Cross will be taken as Main Signal. And it will search for OBV and OBV-MA Cross

If Heiken True:

If MA Cross and OBV Cross both are false, only then Heiken Cross will be taken as Main Signal.

It will search for Heiken Ashi switch.

If MA Cross and OBV Cross and Heiken are all True, it will only use MA Cross as Main Signal. While OBV and Heiken will be used as Validating Signals.

There can be only 1 Main Signal which will generate the BUY/SELL Arrows. All other indicators will be used for validation only.

Once a BUY/SELL Signal is generated, it will check all validating indicators and see if they also indicate a BUY/SELL.

If they don’t validate, then signal is ignored. Or else if everything is in Confluence then you will get a BUY or SELL Arrow and SL and TP lines will be generated.

All Signal Settings:

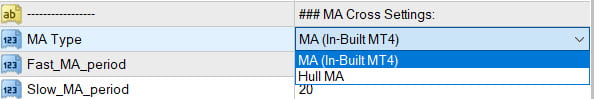

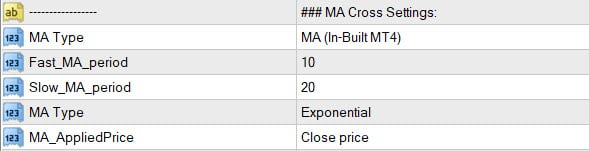

MA Cross Checks (Main Signal)

- MA (In-Built with MT4)

- Hull MA

- BUY: Fast MA crosses Slow MA upwards

- SELL: Fast MA Crosses Slow MA Downwards

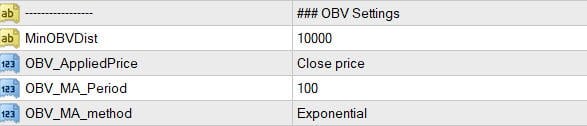

OBV Cross Check (Main or Validation)

If Main:

- BUY: OBV Crosses OBV-MA upwards

- SELL: OBV Crosses OBV-MA downwards

If Only Validation:

- BUY: OBV should be at least Min Distance above OBV-MA

- SELL: OBV should be at least Min Distance below OBV-MA

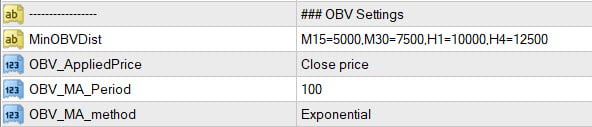

In Dashboard, for MinOBVDist (Minimum OBV Distance) you can also set different values for different timeframes. This will also work in Arrows Indicator.

It’s useful in arrows because you might want to save a common template that the dash will open. And would like all values to be preset.

OBV-MA: Is the Moving Average of “OBV_MA_Period” number of last OBV Values. Using “OBV_MA_method” Moving Average Method.

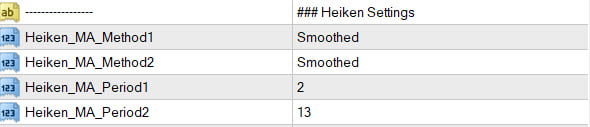

Heiken Cross Check (Main or Validation)

If Main:

- BUY: Heiken Changes from Bearish to Bullish

- SELL: Heiken Changes from Bullish to Bearish

If only Validation:

- BUY: Heiken should be Bullish

- SELL: Heiken should be Bearish

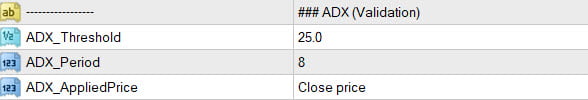

ADX (Validation):

ADX should be above Threshold for both BUY and SELL

BUY: +DI should be above -DI

SELL: -DI should be above +DI

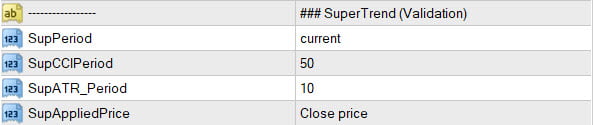

SuperTrend (Validation)

BUY: SuperTrend should indicate Buy (Blue)

SELL: SuperTrend should indicate SELL (Orange)

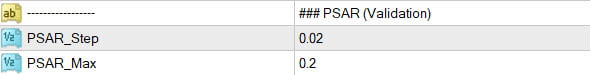

PSAR (Validation)

BUY: PSAR dot should be under the price

SELL: PSAR dot should be above the price

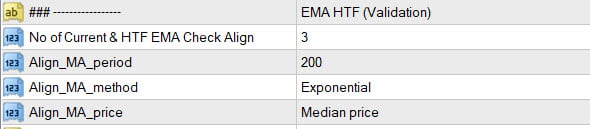

EMA Higher Timeframe Align (Validation)

If Number of timeframes is 3, it will check current timeframe alignment with 2 higher timeframe alignment.

If all are aligned with Main Signal, then it will allow the signal.

Dashboard Indicator Settings:

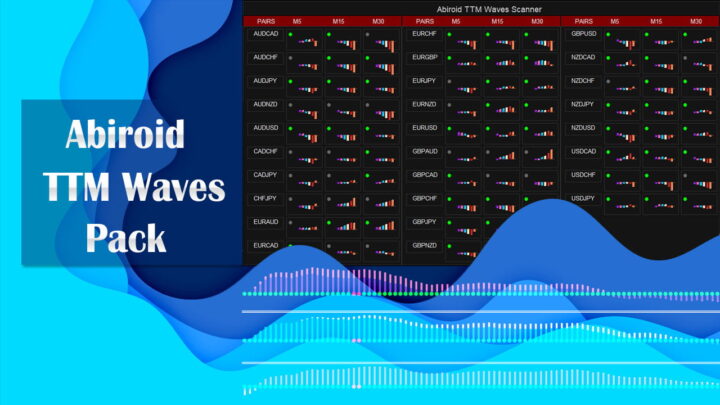

The scanner dashboard will also have the same settings as the Arrows indicator. Along with common dashboard settings described here:

https://abiroid.com/indicators/profit-percent-series-common-settings

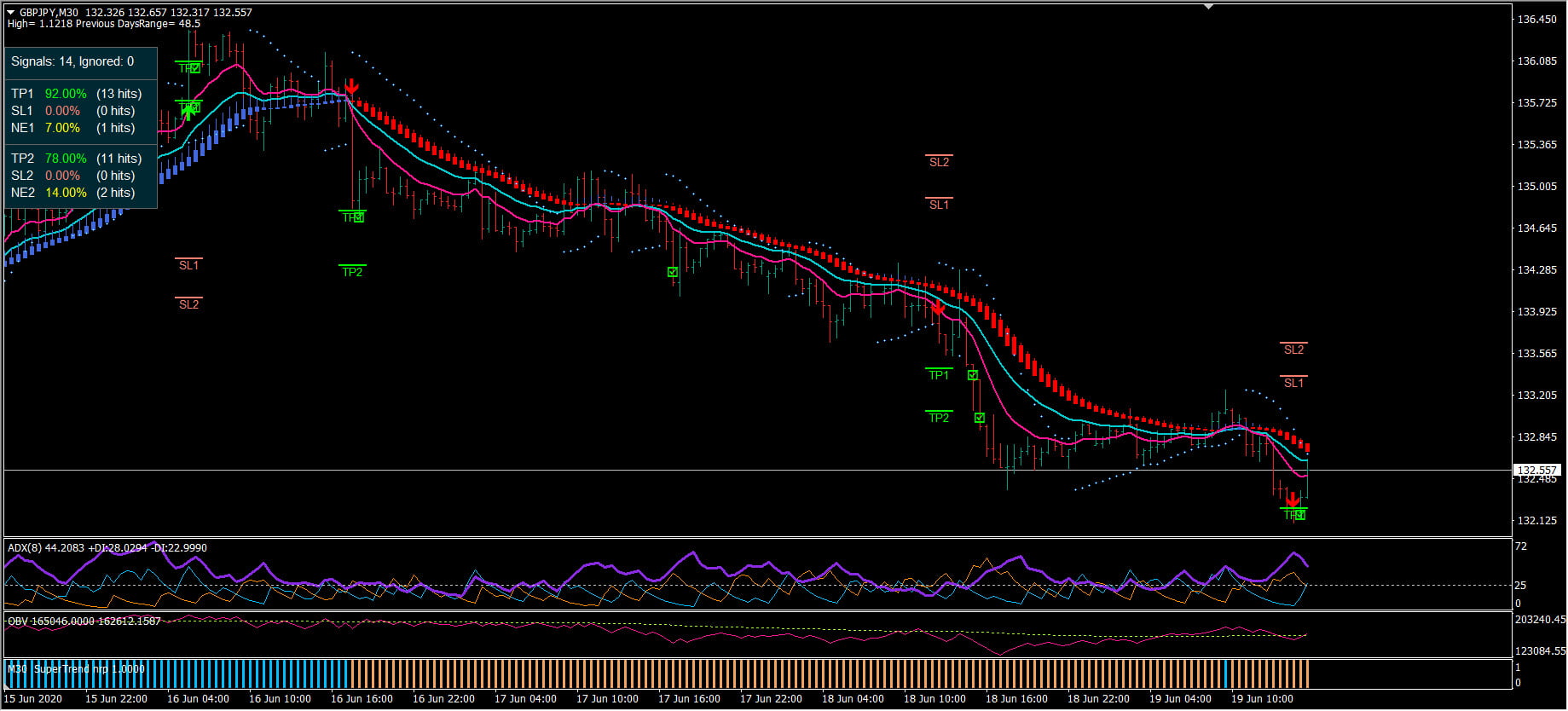

Profitable setup Example:

OBV Cross (Main Signal)

PSAR (Validating)

SuperTrend (Validating)

gives great percentages for Forex M15+ trade pairs.

If you have some great combinations that you have been experimenting with please share your settings and results in the Comments section below.

Thanks for Reading!

| mql_site_link |

|---|

Related products

Abiroid Quarters Scanner

Engulfing Candles Price Action

Bollinger Bands Breakout

Darvas Box Strategy Arrows and Scanner

- Check Darvas Box Breakout

- Check Price Above/Below MA or Darvas Box has crossed MA

- NRTR Trend Check

- Heiken Trend Check

- MA Slope Check

- Higher Timeframes Price and MA check

- Fixed Stop Loss and Take Profit Option

- Variable Stop Loss at Darvas Box or Darvas Pivots or selected MA

- Calculation of Profit Loss Points and Win/Loss Count and Profit Percentage

I have been using this indicator on IC Markets demo account, it is very accurate. With fixed TP and SL, I have made consistent profits. The author is very supportive. The training videos posted by the author on YouTube are very helpful in understanding and customizing the indicator as per one’s strategy. I have never seen anyone providing such an excellent insight into the product, which I think is a must for successful trading.