TD Sequential Examples

This post contains some screenshot examples from my TD Sequential product here:

https://abiroid.com/product/td-sequential-combo-arrows-and-scanner

And my commentary on how to trade the best signals. Note that all of these examples have M5,M15 trades.

But these are just example signals to see how to read the chart.

DO NOT trade immediately after Arrow. Read the chart first. Or else you might have losses.

Setup bars drop was not that much. But price during countdown seems to be ranging which is good.

Wait for a strong Upwards green volume bar and place a Buy. If Pivot point is nearby, place a Buy Limit on that Pivot.

Same way, Setup bars rise was not that much. But price during countdown seems to have started ranging. Which is good.

Wait for a strong Downwards red high volume bar and place a Sell. Wait for only 8-10 more bars. If not the skip signal.

If Pivot point is nearby, place a Sell Limit on that Pivot.

AUDNZD is following the same course as AUDUSD above. Wait for a high volume red downwards bar.

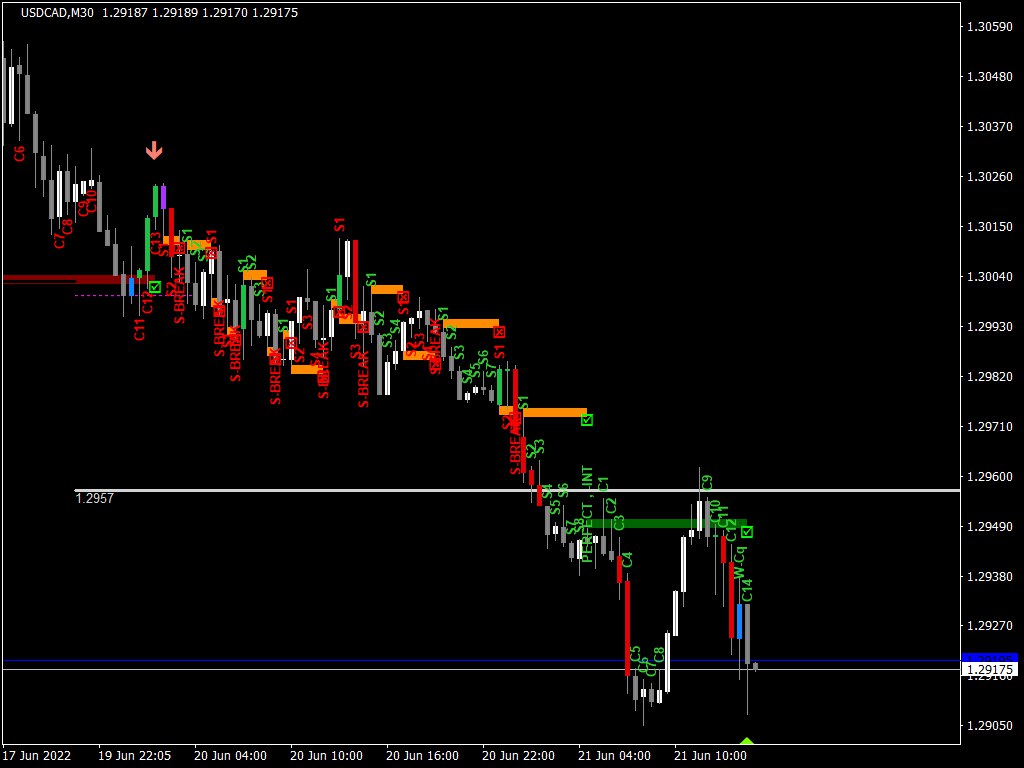

Price during countdown has already gone a bit high. And there’s a possible support forming below it.

Wait for price to hit support near 1.29100 and if price bounces back upwards and forms a green high volume bar, then place a Buy trade.

Setup and Countdown both have a very good rise. And countdown seems to have found a good resistance.

Wait for a high volume red downwards bar but make sure it hasn’t gone too low.

Once again if a Pivot point is near use that for Sell Entry.

Same as above EURJPY. Wait for a high volume red downwards bar.

Wait for only 8-10 more bars. If not the skip signal.

Good time to Sell as a high volume red bar has already happened 3 bars back. But keep Take Profit close.

Because Setup rise was not that much.

Countdown seems to be rising very fast. Has not found a range yet. Price might keep going upwards. So don’t sell yet.

Wait for strong volume red bar downwards. And a range forming.

Price is in a range. But wait for 8-10 more bars.. For a strong volume red bar downwards. If not the skip signal.

Price is still climbing. Range has not yet formed in countdown phase. Price might still rise. So wait for a range to form.

And like always wait for a strong red bearish candle. But only wait for 8-10 more bars.

Price is in a good range. A strong red bearish candle has happened 6 bars back. So a good time to trade Sell.

But setup didn’t rise that much. So keep a close Take Profit.

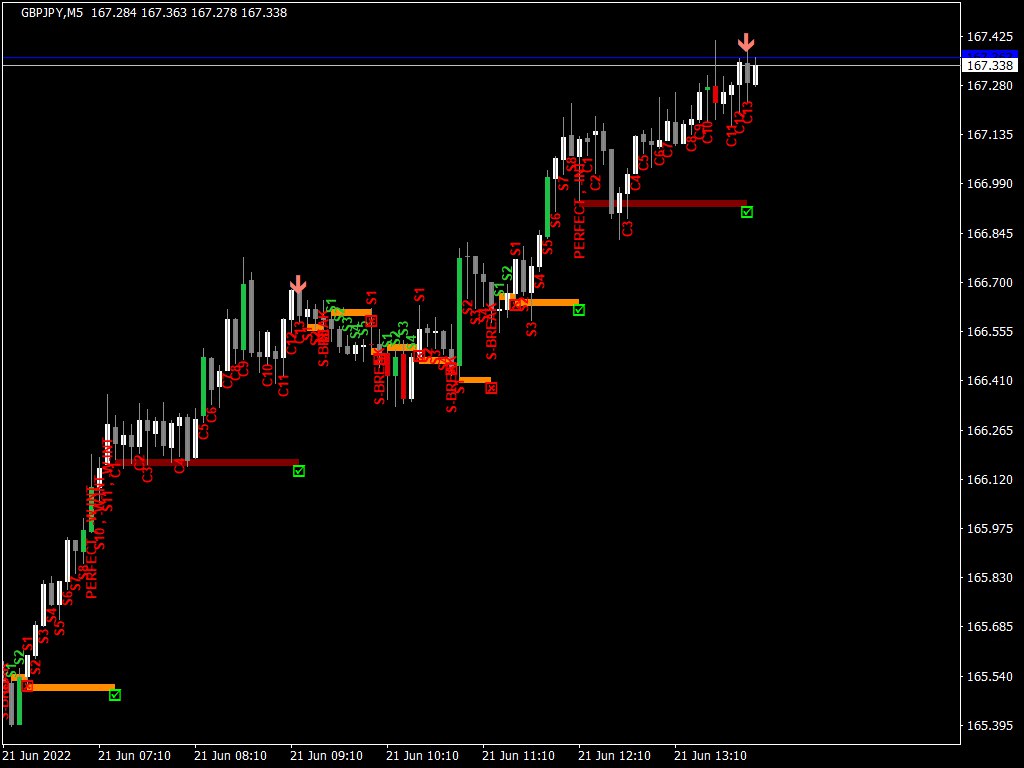

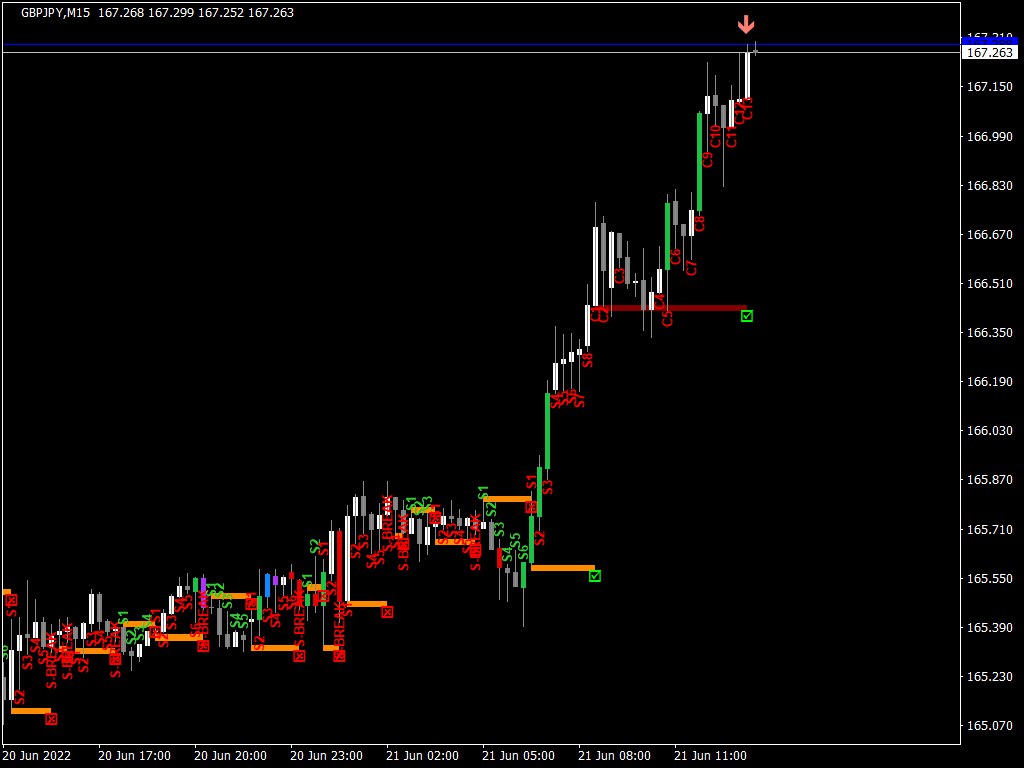

Both above examples are similar, but on different timeframes. Price seems to be rising still. So wait for a range to form first. And a possible resistance level.

If using Pivot levels, trade sell if range forms near a Strong Pivot level.

Strong bearish volume candle has appeared downwards. So wait few more bars to verify the range. As a previous Support also seems to be near same level.

So price will possibly reverse if it’s a strong support. If price still keeps going downwards over next 4-5 bars and does not find a range near support, then ignore this signal.