Murrey Lines Scalper

35 $

Coming soon on MQL5. Contact me.- Selected Murrey Math Line Cross and reverse

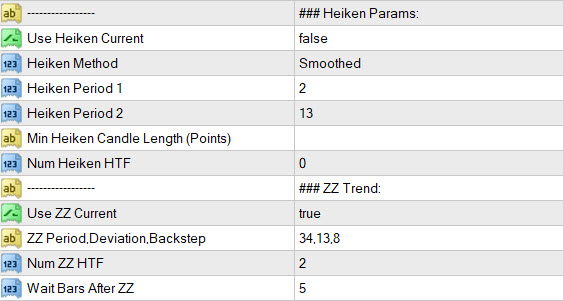

- Heiken Current and Higher Timeframe Trend Check

- Zigzag Current and Higher Timeframe Trend Check

- Min/Max height for crossing candle

- Min Murrey Level Distance

- Fixed SL/TP or variable stops at Murrey Levels

All products are non-refundable. Since these are digital products. No source code available, only executables. Please read product description carefully before buying.

Features:

- Selected Murrey Math Line Cross and reverse

- Heiken Current and Higher Timeframe Trend Check

- Zigzag Current and Higher Timeframe Trend Check

Other features:

- Min/Max height for crossing candle

- Min Murrey Level Distance

- Max Spread Check

- Fixed Stop Loss and Take Profit Option

- Variable Stop Loss and Take Profit on Murrey Levels

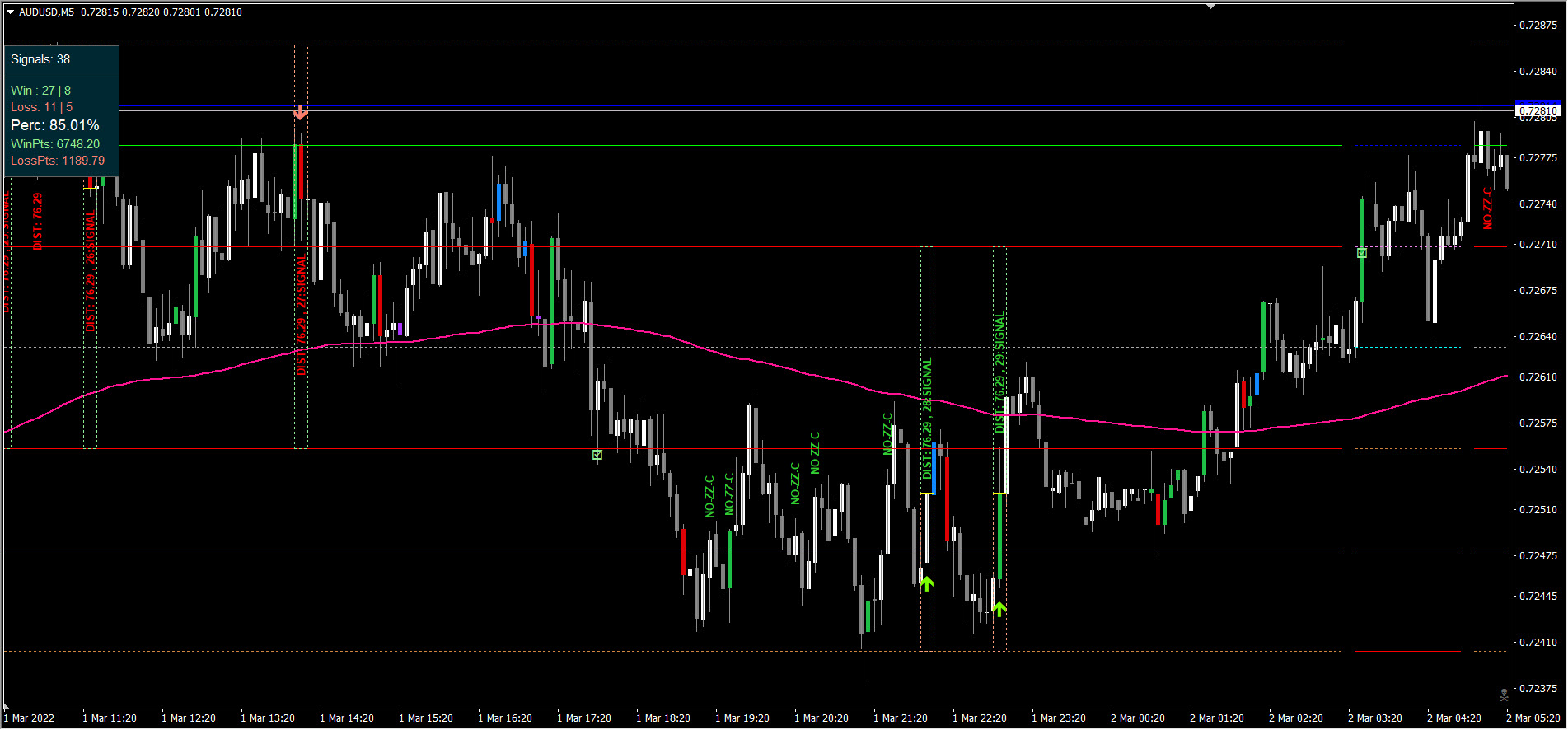

- Calculation of Profit Loss Points and Win/Loss Count and Profit Percentage

- Debug Texts on bars to show why signal skipped

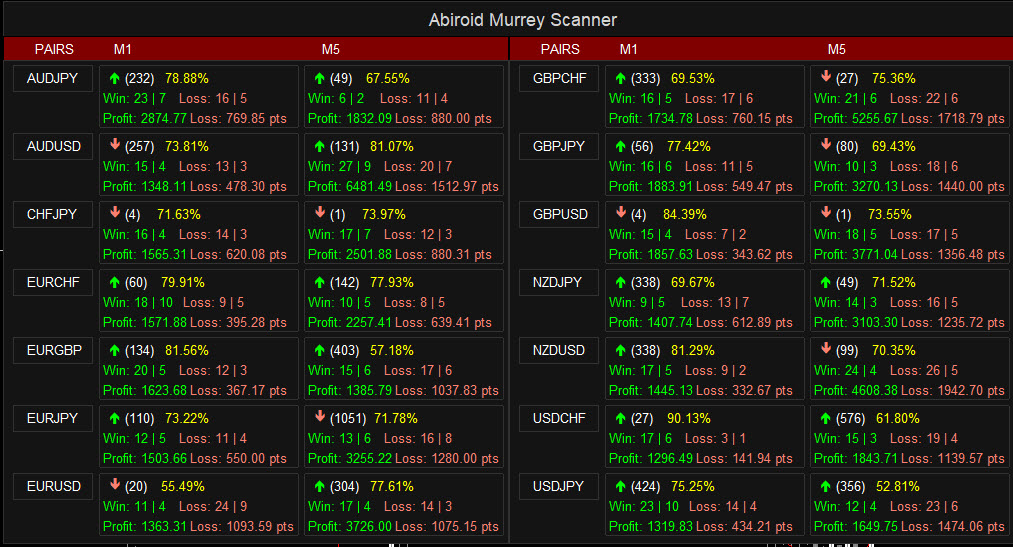

Note, that price behaves differently during different times of day. So always try your strategy in scanner to get Win Rates. And only trade pairs with a higher win rate during that time of day.

Download Extras:

Murrey Lines:

If using Zigzag only on current timeframe use in-built zigzag. For higher timeframes, use this muti-timeframe zigzag:

Heiken:

Sample Template M5:

Free Demo:

Free Scanner:

Place the scanner in same folder as your “Abiroid Murrey Arrow.ex4” to work.

Strategy Explained:

Murrey Lines:

Murrey lines are strong support/resistance areas. And the extreme lines towards the ends are strong Overbought/Oversold areas:

This scalper uses this concept to find best reversal areas.

Read more about individual levels and calculations here:

https://abiroid.com/explained/murrey-lines-explained

Higher Timeframe Trend:

And even inside an ongoing higher trend, there are smaller ranges where price reverses.

The higher timeframe zigzag or heiken trend checks ensure that we are trading towards the overall trend:

Note: Zigzag might shift bars if newer highs or lows are formed. So, it’s best not to trade immediately after current timeframe zigzag signal.

So, we have option: “Wait Bars After ZZ” set at 5. This arrows indicator once drawn will not repaint. But if zigzag later shifts and arrows indicator is reloaded on chart, then arrow might change. Which is why it’s advisable to use Higher timeframe zigzags. And to not reload arrows indicator once placed on chart. To avoid repainting. To make it fully NRP, use Heiken Trend instead of zigzag, as Heiken ashi does not repaint after candle is closed.

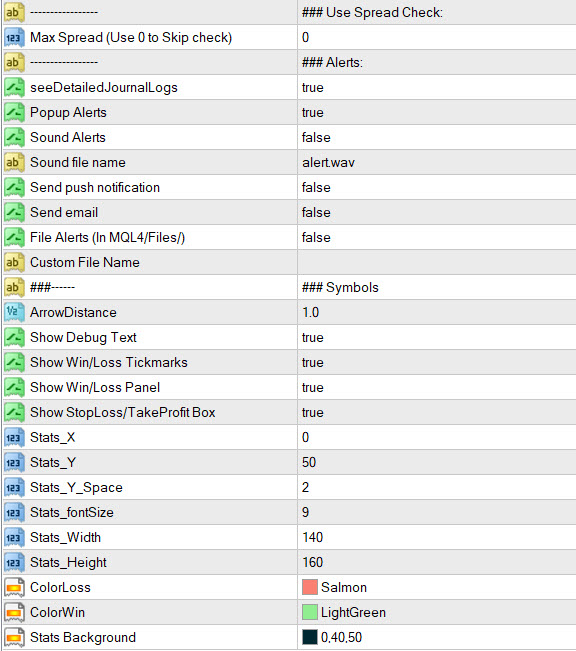

Settings Explained:

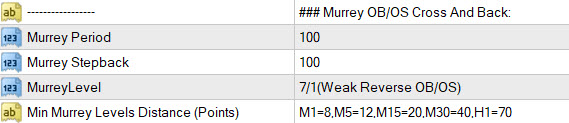

Murrey Settings:

Period: The number of bars for which Murrey Lines are calculated.

And Stepback bars back after the period, it should start looking for Highs and Lows. And using this it calculates the fractal.

Murrey Level: The level for which price should cross and come back.

For BUY price should cross below this level and come back up.

And for SELL, it should cross above this level and come back.

Number of Bars Cross Back: Price should enter Murrey level and cross back out within these max number of bars.

e.g.: If this number is 10, then for BUY, price should go below Level and come back up within 10 bars.

Min Murrey Levels Distance: Distance between individual Murrey levels should be more than point distance specified here.

Calculate all Min DIstances using Cross Hair tool:

Cross Hair Tool For Point Distances

Win Rate Calculations:

Read more about Win Rate calculations and other scalper common settings here:

Scalper Common Settings Explained

Variable StopLoss can be set at Murrey Lines.

So, it will first check if fixed StopLoss is true or not. If false, only then it will use Variable StopLoss at Murrey lines.

If TP Level Distance is specified, it will create Take Profit at that number of levels above from entry cross check Level.

If it is 0, then it will check TP Ratio. And it will calculate TP Ratio based on stop loss using this multiplier.

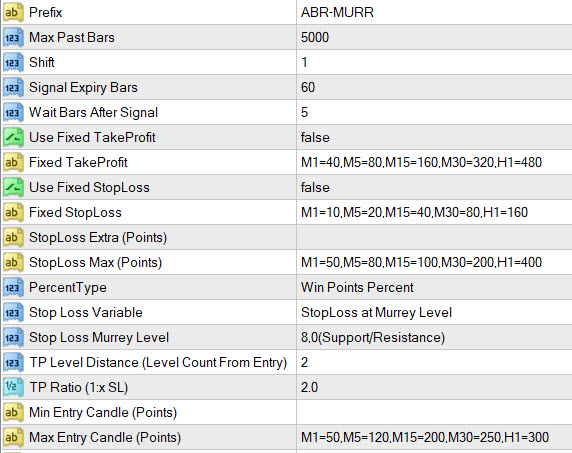

Trend Check (Current and Higher Timeframes):

It uses Heiken or Zigzag to determine ongoing trend. As mentioned above, Zigzag can keep shifting to next bar while semafor is still forming.

So best to set Wait bars after ZZ to at least 5.

Heiken is fully non-repainting.

It will check current TF for trend if Use ZZ Current is true. Or Use Heiken Current is true. If false, then it will only check higher timeframes.

Num Heiken HTF or Num ZZ HTF indicate how many higher timeframes to check for ongoing trend.

If current TF is M15 and this number is 2, it will check M30 and H1 trends align with direction of signal.

Other Settings:

Max Spread: Used to define max spread allowed. Pairs will Spread greater than this will be ignored. 0 means don’t check.

Remaining are for Alerts, and drawing the win rate panel etc.

Read detailed common scanner settings here:

Abiroid Scanner Dashboard Common Settings

Scalping Strategy:

For quick scalping, the best strategy would be to look for a reversal when price has crossed a level like 2/8 or 6/8 and reversed from them quickly.

And to trade in direction of ongoing trend. Keeping stop loss at level before and Take profit 2-3 levels ahead.

Since price holds very well near this level, even if price is ranging, it will give good signals.

And if price volatility is high, then signals are even better, during the range:

Entry at levels 6/2 will give you a lot of signals. And is good for quick scalping. So be careful an close quickly.

So, it is good on lower timeframes like M1,M5. But if volatility is low and price is ranging near these levels, then you might get nearby signals like this:

So, either increase Wait Bars between signals to higher. Or only trade 1 or 2 signals, and wait for them to fully finish first.

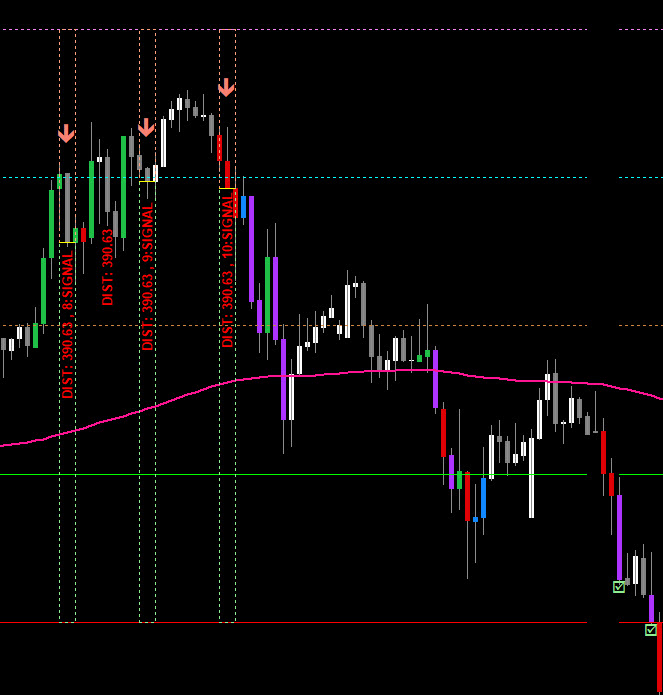

For higher timeframes like H1, since we don’t want to do quick scalping, it is more suited to use levels like 8/0

This will give much fewer signals, but they will be more accurate.

Same with H1, if price is ranging near a level, you might get multiple signals:

You don’t need to trade all signals. Also be mindful of signals with strong high volume bars using VolumeCandles.ex4.

As those will be the best level reversals.

Be Careful:

Don’t trade whipsaw or choppy markets.

https://www.investopedia.com/terms/w/whipsaw.asp

https://www.investopedia.com/terms/c/choppymarket.asp

Also, don’t trade when volatility is too low. Because price won’t reverse effectively.

Changelog:

v1.0 Base version

v1.1 Added feature Check Murrey level reversal within Max Number of Bars